User deep dive for a financial services provider.

Overview

Gen Z has grown up in a world they have experienced as unstable, unsafe, and competitive. The destabilizing events that occurred over the course of their lifetimes have come alongside the emergence of unprecedented access to tools, platforms, and programs that promote individual agency via online education, e-commerce, and connective technologies.

These experiences, insights, opportunities, and the possibilities that confront them have created a generation with unique financial attitudes and behaviors.

By exploring the spaces in which Gen Z lives and speaks, this study examined the financial behaviors and attitudes unqiue to the generation.

Research questions:

What are the drivers of behavior and attitudes for Gen Z broadly? Where are there notable differences and nuances amongst the cohort?

What experiences or exposure define these individuals’ relationship to finance? How do they learn about and build financial habits? What are the cultural forces changing how they think about their relationship with a financial services provider?

What are the key moments in the journey of discovery for high school and college students?

Where are there opportunities to influence the journey, impact decision making, and engage these student segments?

Research Design

The research was designed to uncover conversation, sentiment, online behavior, attitudinal forces that shape the development of financial habits and behavior. Given that the project was constrained to secondary research, we had to get creatives with our methodology to ensure that we were uncovering new insights.

To do this we reviewed academic studies, scholarly articles, online conversation and content including Instagram, YouTube, Reddit, Public Forums, comments sections, Twitter, Facebook and followed trails of conversations around the web until we were able to identify strong patterns of behavior and insight.

The research was iterative, as we discovered new layers of insight, we delved deeper, revisiting the places and spaces of conversation to continue to collect data and information.

Research Activities:

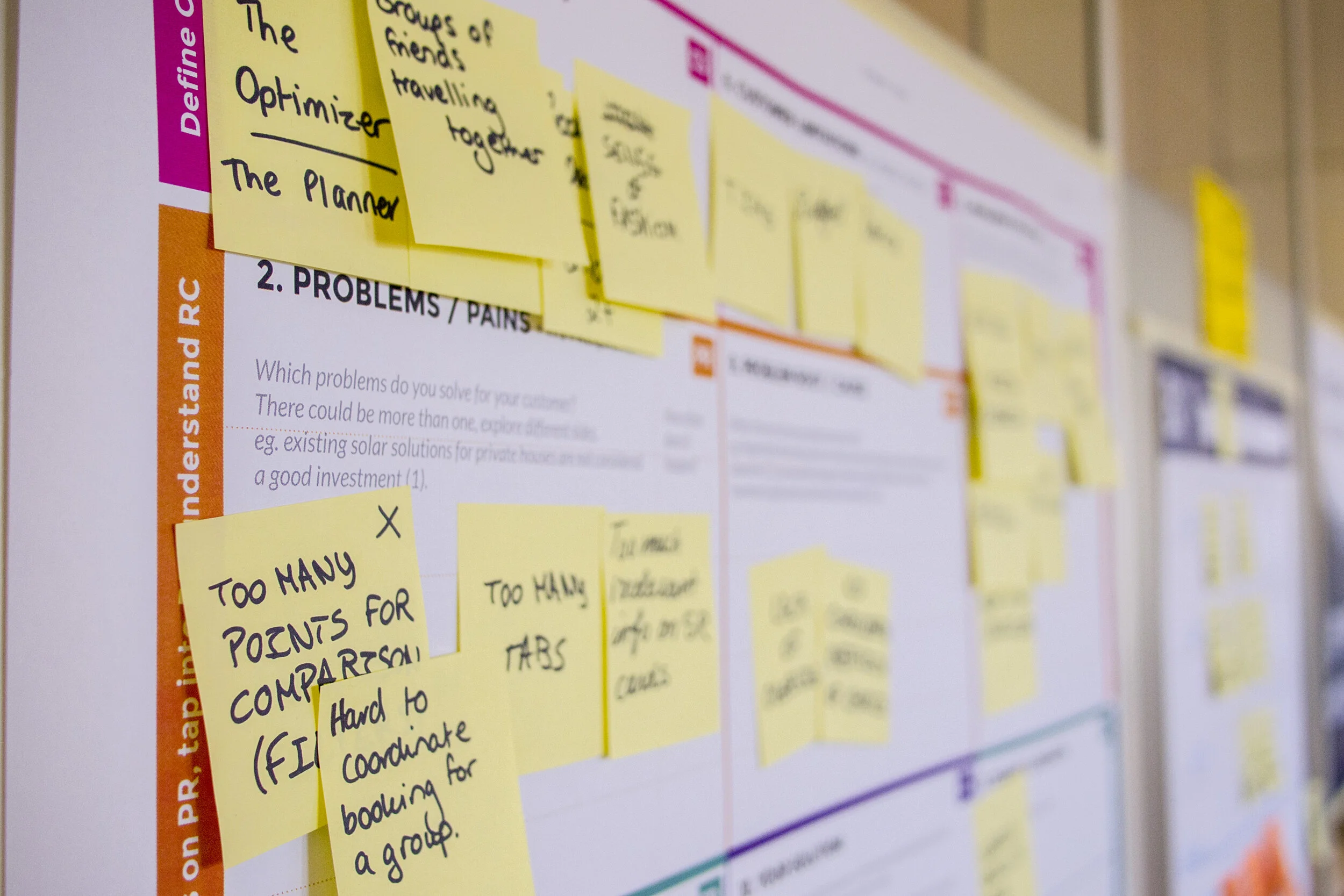

Social Listening, Cultural Forensics, Customer Journey Mapping, Strategy & Persona Development, Socialization and Strategy Workshopping

Broaden Our Perspective

Discover

In this phase we find allies, talk with experts, follow ethcial guidelines, involve stakeholdres, hunt for data sources.

Secondary Research

This study began with a review of existing academic studies and insights. This review yielded an understanding of some basic heuristics in understanding the financial behavior of any cohort. This research provided the foundation for all of the research that followed.

In this research we discovered two key insights:

1) Financial attitudes are less dependent on age than they are on early exposure and upbringing.

2) Greater education leads to more engagement with financial services products.

These insights help define a 2x2 to better understand attitudinal differences among the cohort.

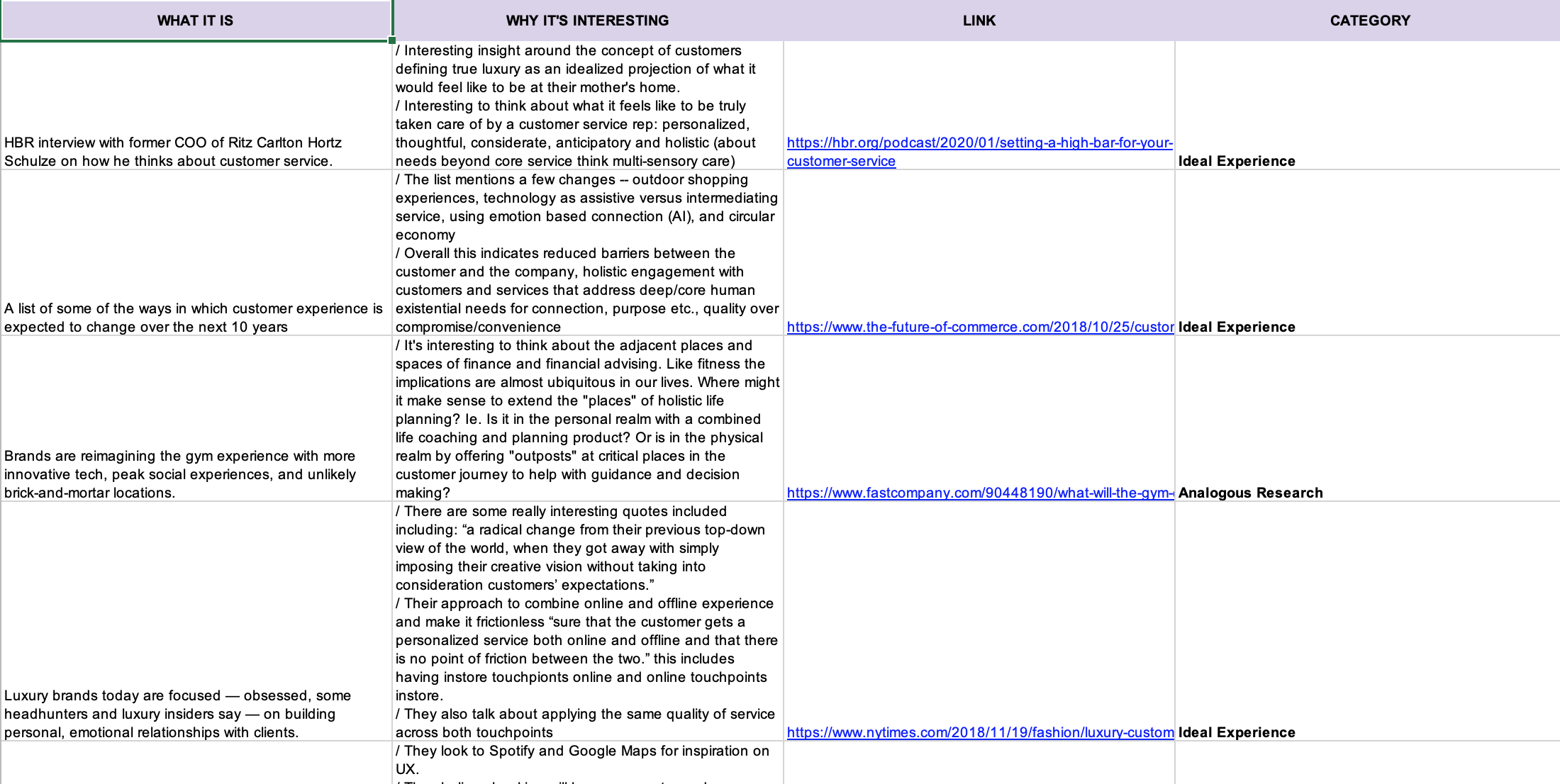

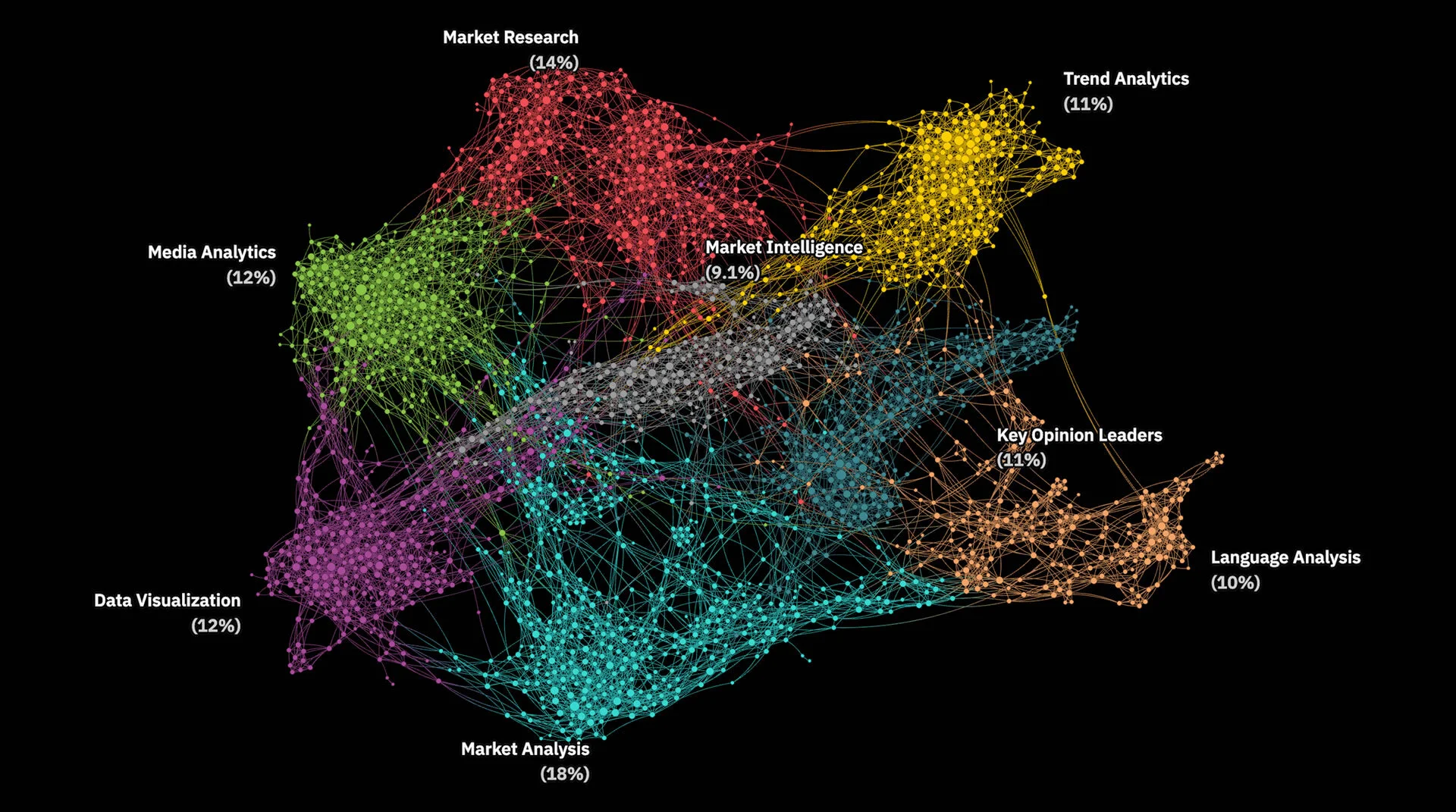

Landscape Research

In this phase we reviewed industry reports and market research to understand the popular understanding of Gen Z trends and behaviors in financial services. We identified signals of change in the overall landscape to get a sense the types products and services available now and also those that are likely to be on the horizon.

Sources: Industry reports, market research, specialized industry reports, technology reports, extreme user case study analysis, identification of outlier behaviors and stories.

Sample results

Cultural Discussion

An analysis of cultural discussion occurring on media platforms was taken to get a better sense of where there were there were concentrations of reporting. This analysis also gave us insight into lead-user type stories which were integrated into the signal research.

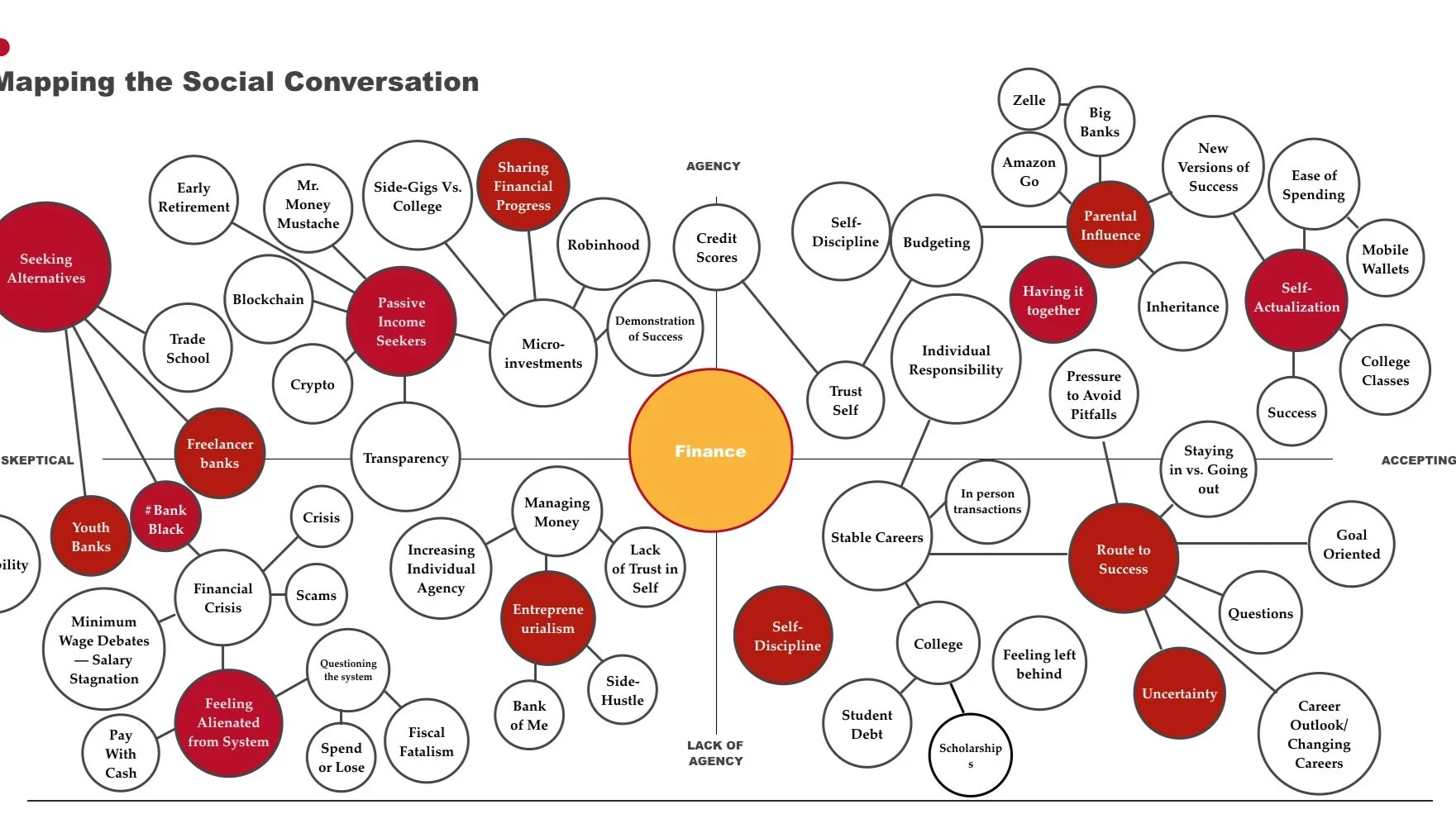

Social Conversation

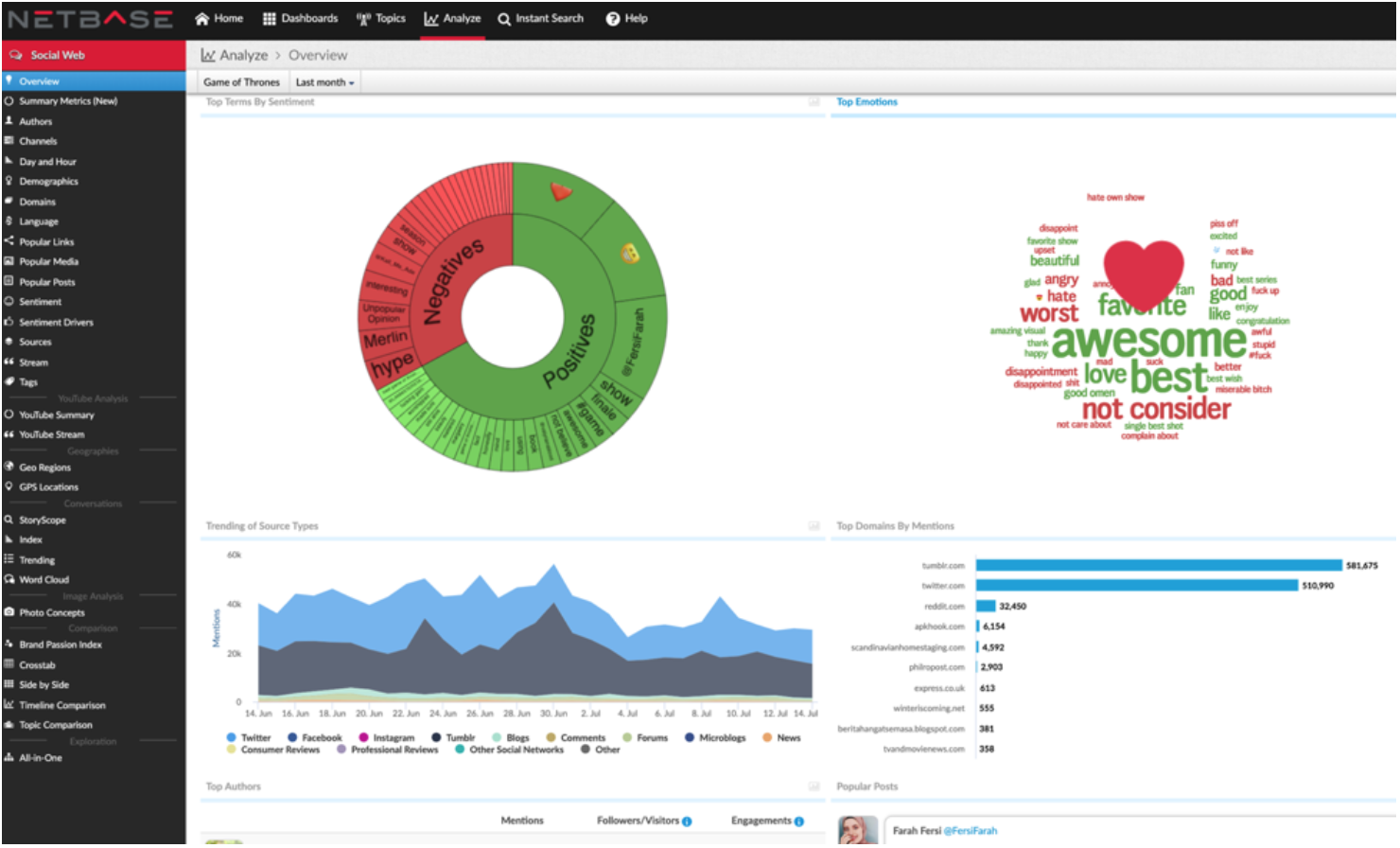

This analysis was conducted to dive deeper into conversations, hashtags, trending social topics and general unfiltered attitudes towards finance. It gave us directionality as to where to look deeper for conversation, gave us a broad understanding of the sentiment and attitudes towards existing products in the market.

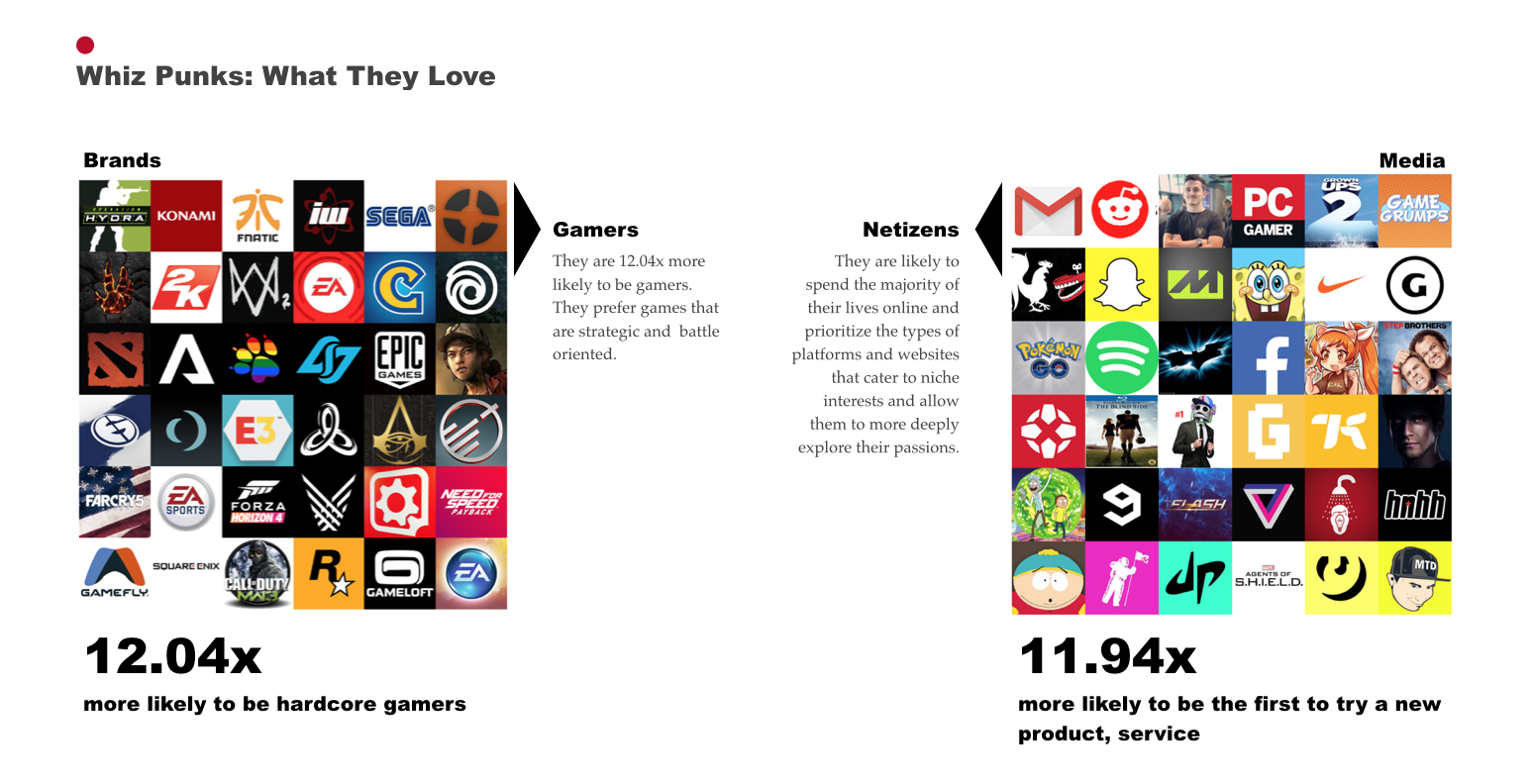

Attitudinal Study

We conducted a psychographic analysis to better glean insight into the types of behaviors and brands that were most common amongst each one of the segments that were identified.

This data was used to better understand affinities, validate the nuances of the segments and understand channels and behaviors that were most relevant to each group.

Understand what we’ve learned

Explore

In this phase we explore possibilities through designing frameworks for understanding the data.

Pattern Finding

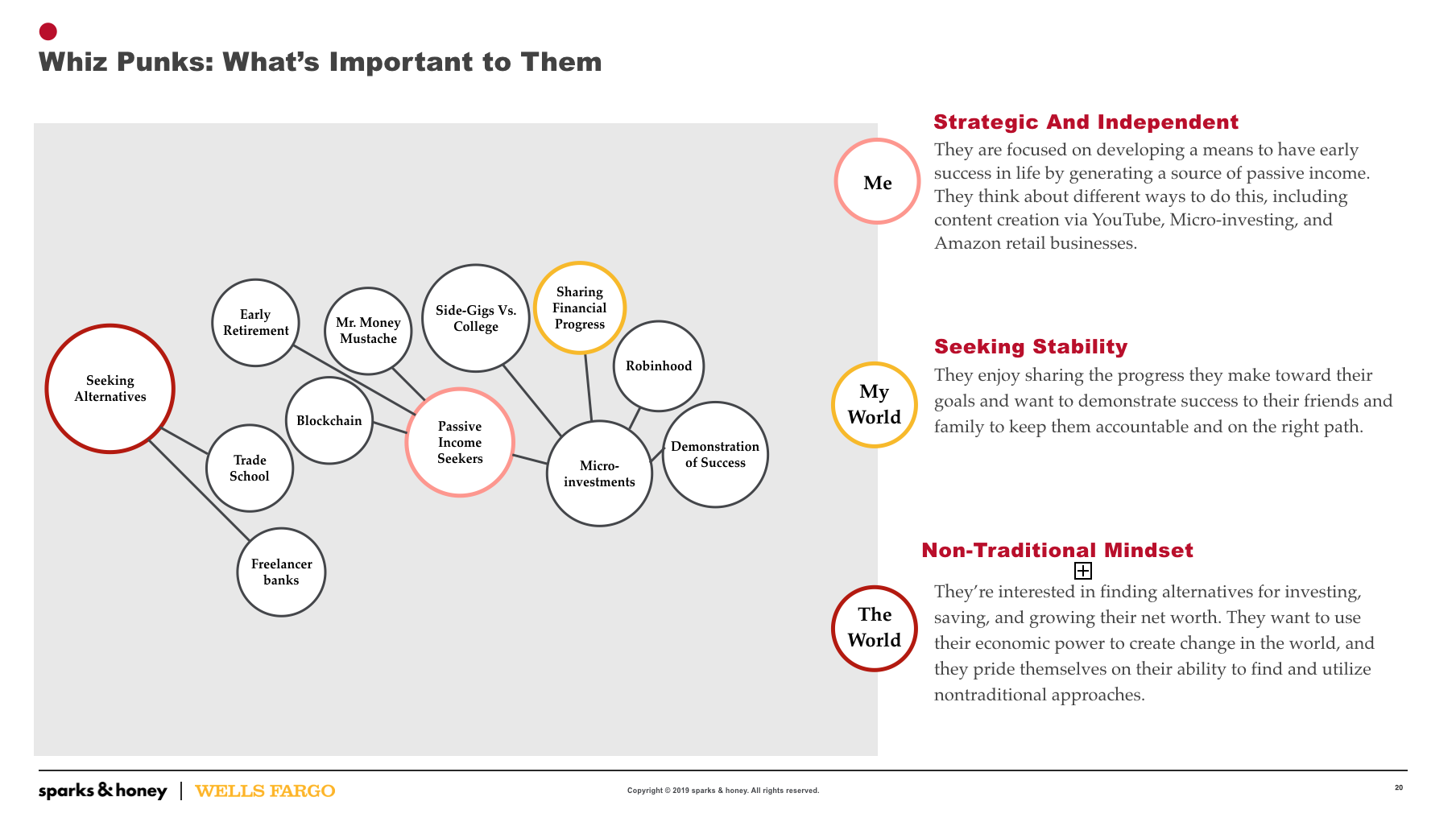

The data was collected and synthesized to show case the conversational and cultural foundations of each of the major segments that were identified. This synthesis includes thematic highlights (below), quotes, identifiers, backgrounds and some early signs at key behavior.

Thematic Intersections

Each of the groups was analyzed through the lens of three overarching behaviors for the broader cohort. Each conversation broken up into these three qualifiers to infer greater understanding of behavioral drivers.

Sample

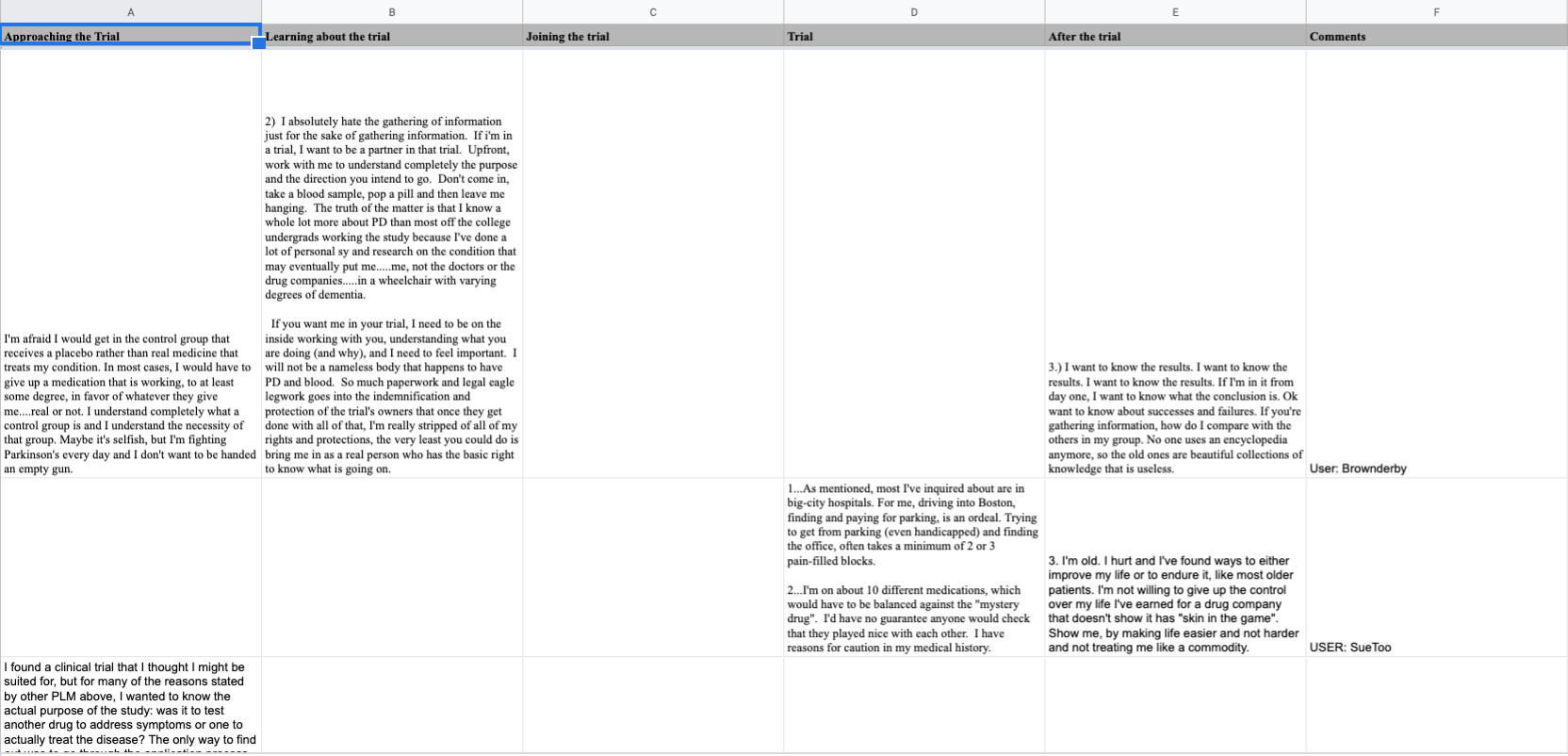

Time Mapping

The quotes, signals, desk research and other data were organized in a journey to help us both understand and narrate the development of attitudinal dispositions and also identify the key moments for interaction with the segments.

Understand what we’ve learned

Listen

In this phase we monitor user sentiment, reduce the need for training, communicate future directions and recruit people for future research.

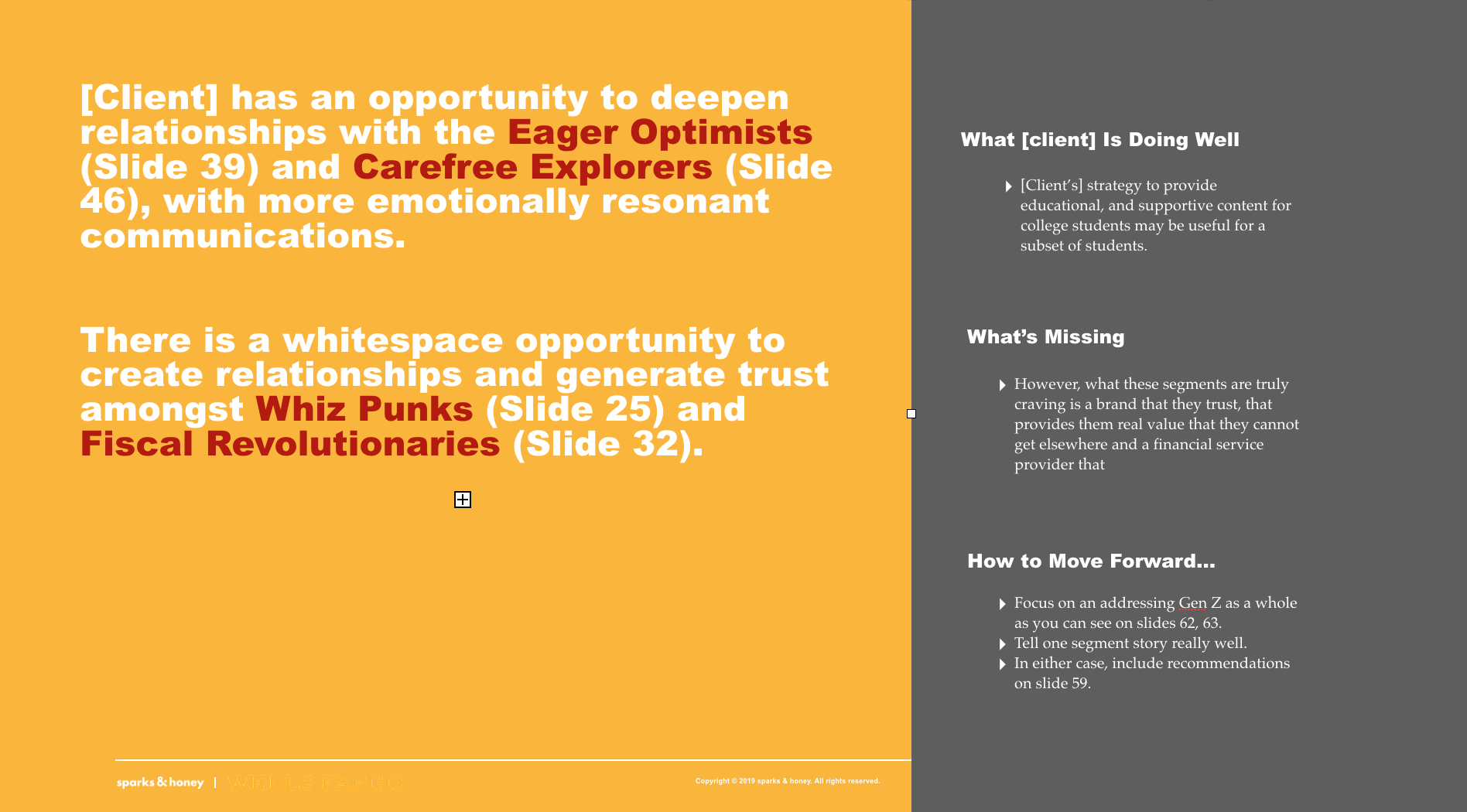

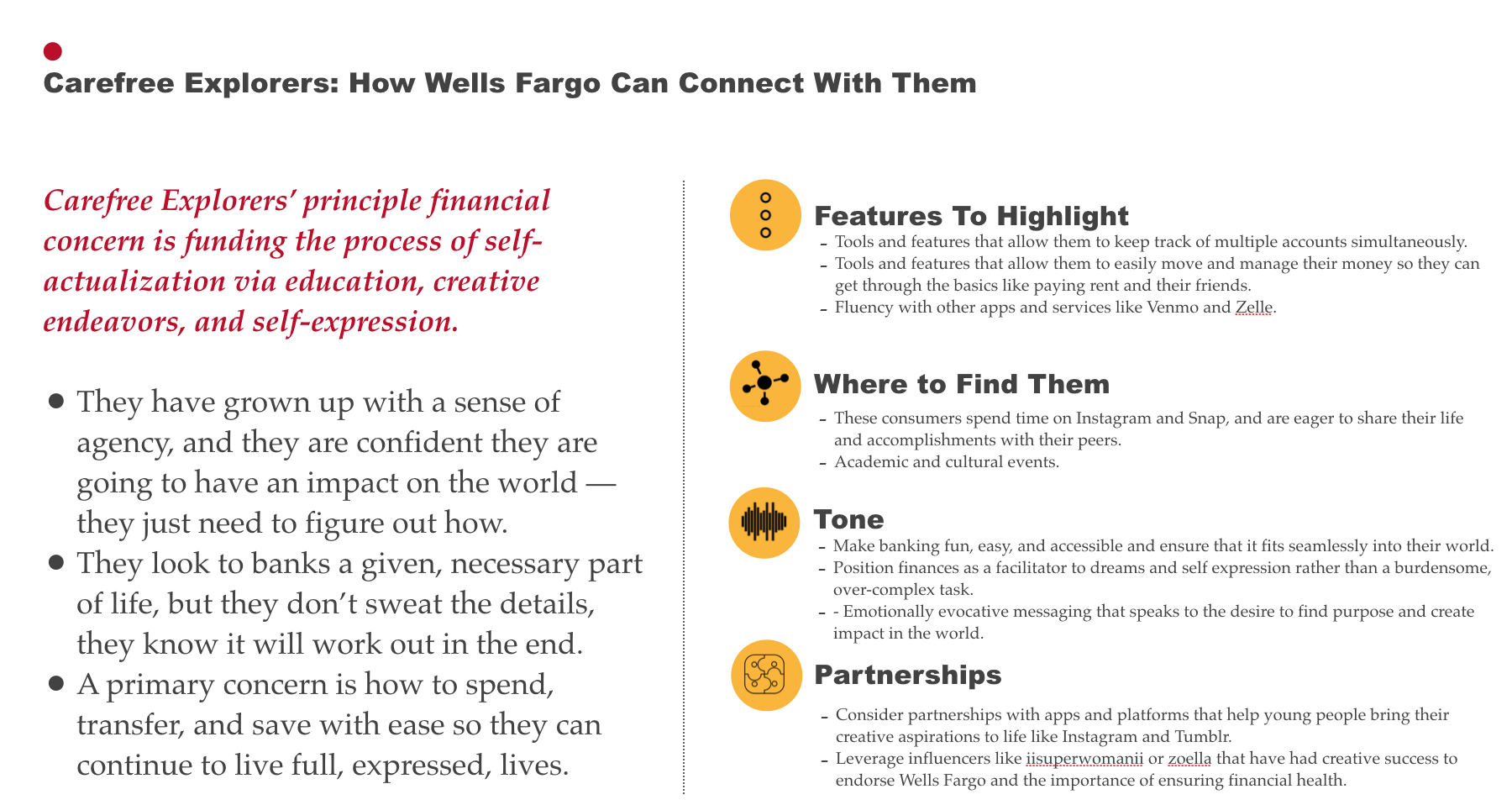

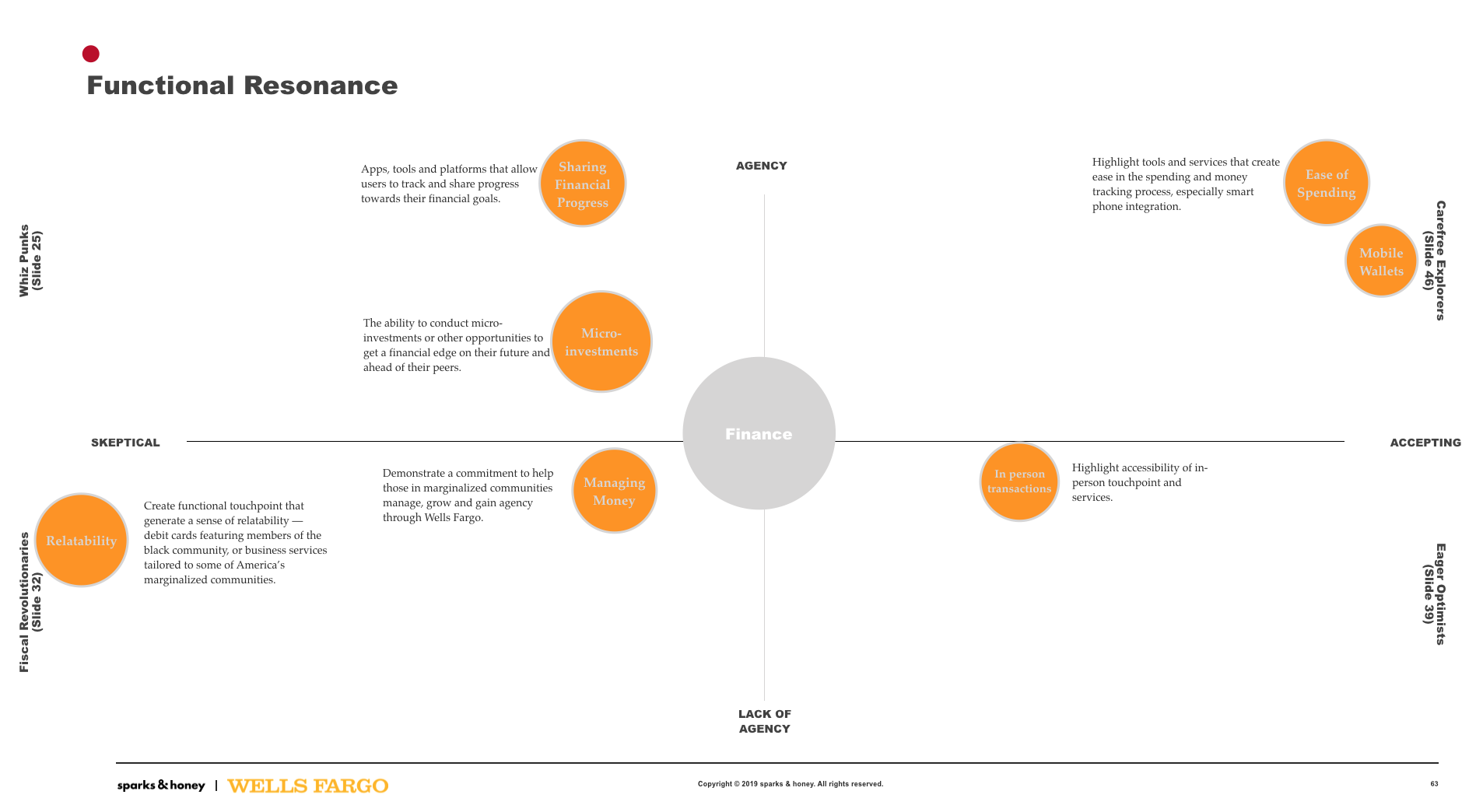

Recommendations

With the complete analysis, we we compiled recommendations which included product, feature, partnership and communications recommendations as well as an overall strategy for the client moving forward.

The research fundamentally shifted the way that they view their customers and so sought to give them recommendations across their business and core operational functions including product design and communications.

Training

In order to make the research more actionable, we created a tool kit for the managers to use in design and communications briefings. The toolkit highlighted key emotional and functional leverage points to help to ensure that future endeavors were resonant and impactful to their the most important groups.